Einblick

The uvZTA – A Brief Explanation of the Customs Tariff Information for VAT Purposes

1. Dezember 2023

Published

1. Dezember 2023

traide

info@traide.ai

Binding tariff information (BTI) is a term known to many businesses – however, the non-binding tariff information (non-BTI) for VAT purposes is less well known. In this article, we explain what the non-BTI entails, when it is useful, and how companies can apply for it to avoid uncertainties in applying the correct VAT rate.

Tax-privileged sales (7% vs. 19%)

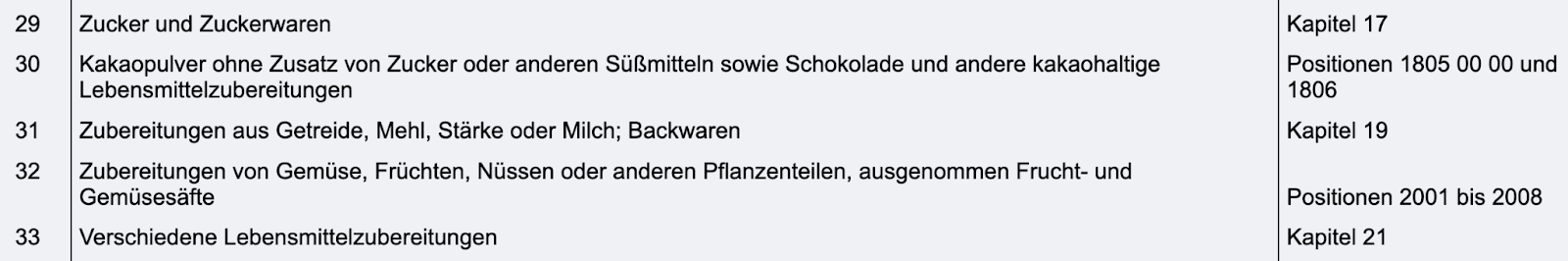

Only certain products such as food, books, art objects, and others listed in Appendix 2 of the German Value Added Tax Act (UStG) are subject to the reduced VAT rate of 7%. This rate applies to deliveries, imports from third countries, intra-community acquisitions, and rentals. Other items not listed in Appendix 2 are taxed at the standard rate of 19%, unless an exemption under Section 2 of the UStG applies.

Distinction of privileged items according to the customs tariff

The privileged items are listed in Appendix 2 of the UStG, and their customs classification in the customs tariff (chapter, heading, or subheading) determines their tax rate. If an item is listed in a chapter, heading, or subheading referenced in Appendix 2 of the UStG, the reduced rate automatically applies. The classification of these items in the customs tariff is done according to customs law rules.

Non-binding tariff information for VAT purposes

If there are uncertainties regarding the application of the tax reduction to a delivery or intra-community acquisition, clarification can be obtained from the Educational and Scientific Center of the Federal Finance Administration (BWZ). Alternatively, state tax authorities, such as the tax offices, can apply for a non-BTI for VAT purposes.

Online application

An online application through the https://www.zoll-portal.de/ with a user account is possible. After submitting the application, a receipt with a process number and an application support document is received. This document allows samples or specimens to be attached. The non-BTI is then delivered to the electronic mailbox in the customs portal, and notification of receipt is sent via email.

Application by mail

To receive a non-BTI for VAT purposes, the form Application for the issuance of non-binding tariff information for VAT purposes (Form 0310) should be downloaded from the customs administration website and filled out. The application should then be sent to the appropriate office of the BWZ. The non-BTI will be sent in written form by mail.

The non-BTI includes a note on the current applicable VAT rate and is made available to the applicant, their responsible tax office, and the superior tax authority. The issuance of information is free of charge. It is important to note that all information in the non-BTI, particularly the VAT rate, is non-binding and does not grant a legal claim to a specific customs classification.

traide Support

Whether VAT reduction, customs tariff or export control – the customs classification is always the starting point. An incorrect heading does not only lead to deviations in the customs area but can also have tax implications.

traide AI helps you to determine the correct customs tariff number safely and quickly – even with complex product descriptions or incomplete data. Our software identifies relevant features, checks existing customs classification for accuracy, and automatically adjusts master data.

This way, you avoid errors in classification and taxation – and create the foundation for informed decisions, even with non-BTIs or binding information.