Customs Tariffs and Fees: How to Calculate Costs for International Shipping?

Lilla Zsitnyanszky

May 24, 2023

The amount of customs duties and taxes (import duties) to be paid for an import shipment depends on various factors. Below, we will examine the factors that influence the fees paid in the end:

Customs Tariff Number

Firstly, the customs tariff number is important, which is used to classify the goods. Using this number, the appropriate taxes, duties, and regulations are determined. The goods and the description on the commercial invoice must match the customs tariff number so that everything can be correctly identified. traide can significantly assist you in this process, ensuring that you use the correct tariff rate at all times.

Value of Goods

Furthermore, the value of the goods, including freight and insurance costs, is relevant. This value is used to calculate the duties and taxes and to process the goods through customs. Therefore, it is very important that the value of the goods is accurately stated on the commercial invoice, considering all relevant factors in the calculation.

Free Trade Agreements

International trade agreements between countries can influence the amount of charges. There are various reductions within groups of countries. In some cases, the goods may even be exempt from duties.

Incoterms®

The Incoterms® on the commercial invoice govern the agreement between the shipper and the recipient, determining who pays for shipping costs, including taxes and duties.

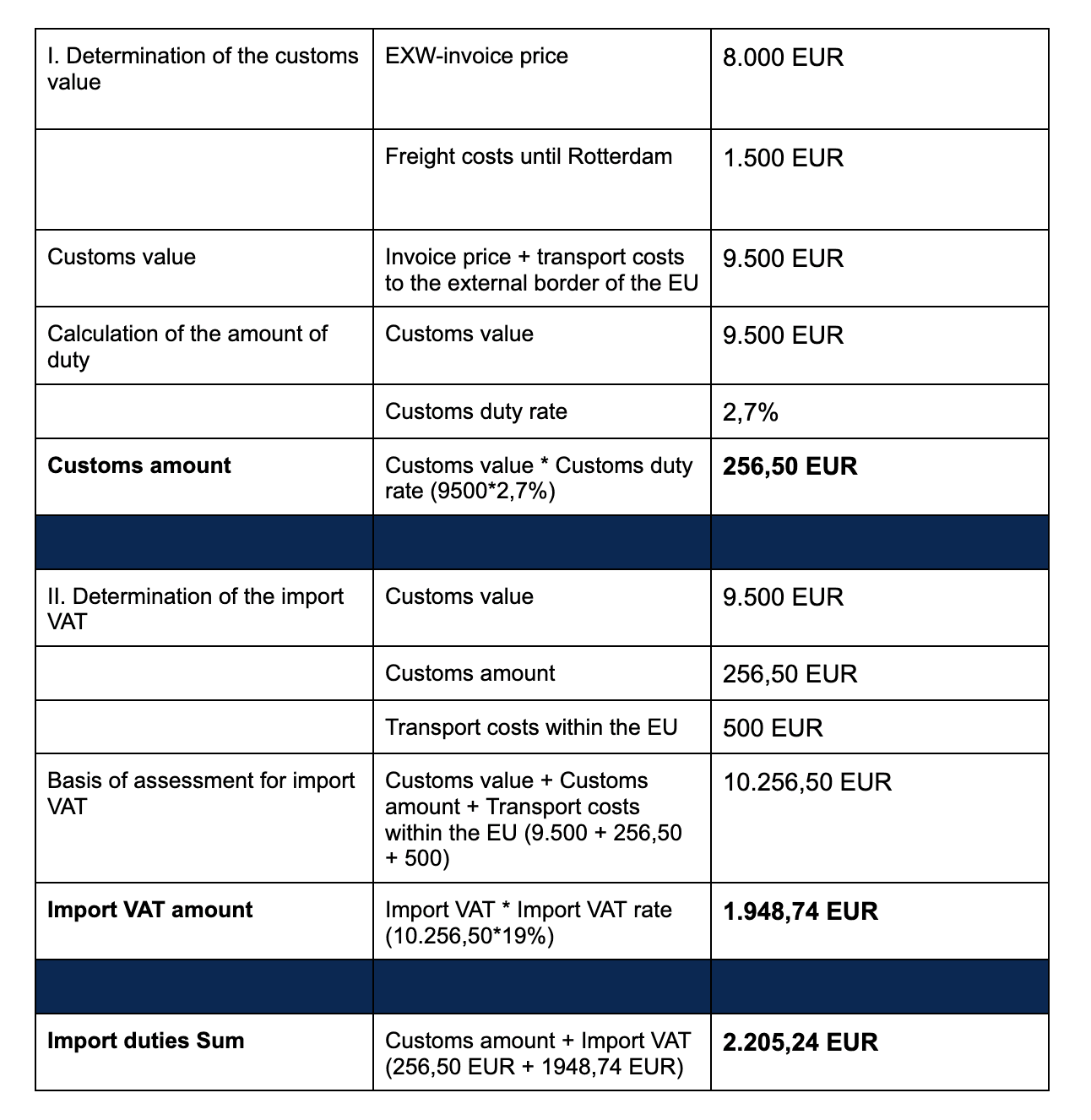

Example Calculation of Import Duties in Germany

For example, if a fitness device is imported from the USA to Germany, import duties need to be calculated. The transport is done by sea via Boston (US) and Rotterdam (NL) to Berlin (DE). The customs tariff number of the device is: 95069110.

Other calculation elements:

The price of the goods is 8,000 Euro (EXW).

Freight costs to Rotterdam: 1,500 Euro.

Transportation costs Rotterdam-Berlin: 500 Euro.

Customs rate according to the customs tariff number: 2.7%.

Import VAT in Germany: 19%.

Based on this information, the import duties can be calculated.

The calculation demonstrates that the fitness device, which originally cost 8,000 euros, incurs additional import duties of 2,205.24 Euro upon its arrival in Germany. This results in a total price of 10,205.24 Euro. Additionally, there might be further costs such as customs broker fees, insurance expenses, surcharges, and processing fees for additional services.

traide Support

From the provided calculation example, it can be observed that the customs rate and consequently the payable duties significantly depend on the tariff number. With traide AI, you can avoid costly errors in classifying your goods and, consequently, in the duties to be paid. We are excited to introduce you to traide through a demo and are available to answer any questions. Reach out to us at info@traide.ai.