Fashion Forward: Customs Classification in the Fashion Industry (Chapters 61 and 62)

Lilla Zsitnyanszky

September 27, 2023

Customs classification can always be a challenge, especially in the field of fashion. In this post, we provide an overview of the key information that should be considered in the textile sector. Section XI (Textiles and Textile Articles) is the most extensive section with 14 chapters in the customs tariff.

This includes:

1. Textile raw materials (e.g., silk, wool, etc.),

2. Semi-finished products (e.g., yarns, fabrics),

3. Manufactured goods (e.g., clothing and clothing accessories),

4. Textile waste.

A possible structuring of this section would be as follows:

- Chapters 50 - 55: Textile raw materials, semi-finished products,

- Chapters 56 - 60: Special yarns, fabrics, and certain finished textiles,

- Chapters 61 - 63: Finished textiles.

In terms of scope, in this post, we will focus on an overview of clothing items according to Chapters 61-62. However, it is important to emphasize that the classification criteria for textile raw materials are equally applicable when classifying apparel, clothing.

Chapters 61 and 62: Apparel and Clothing Accessories

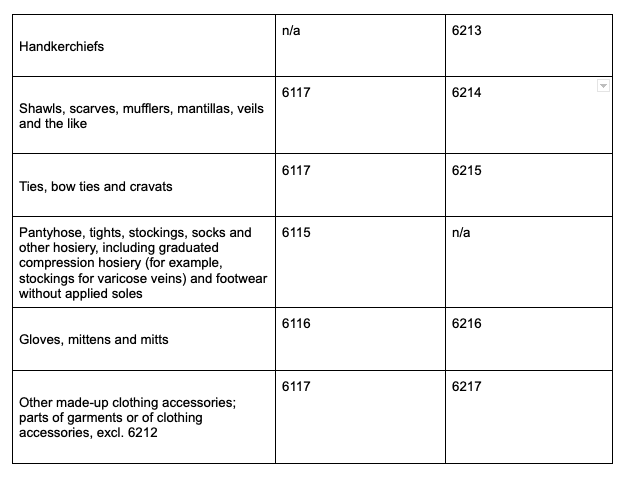

The difference between Chapters 61 and 62 lies in the nature of the processed textile flat goods. While Chapter 61 includes clothing and clothing accessories made from knitted or crocheted fabrics, Chapter 62, on the other hand, contains clothing and clothing accessories made from woven fabrics, non-woven fabrics, lace, and similar materials.

Although the structure of both chapters is almost identical, they also include goods that are usually made exclusively from one of the mentioned flat goods due to their intended use. Therefore, such goods do not have a corresponding position in the other chapter. An example of this is knitted socks, which are assigned to position 6115.

The goods in both chapters can also include parts and accessories made from materials such as fabrics, fur, feathers, leather, plastics, or metals. Electrically heated goods also remain included in these chapters.

Men's or Women's Clothing

According to the notes, garments with a front opening whose two edges close or overlap with the left side over the right are considered garments for men or boys. If the openings close or overlap with the right side over the left, the garments are considered garments for women or girls.

These provisions do not apply when the cut of the garment clearly indicates that it is intended for one gender or the other. Garments that are not clearly recognizable as men's or boys' clothing or women's or girls' clothing are classified as women's or girls' clothing.

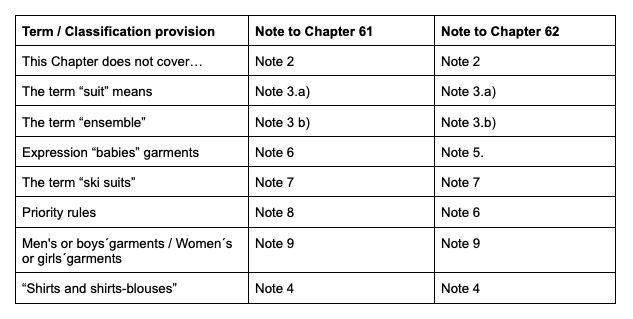

Overview of the Notes for Chapters 61 and 62

In addition to the "Notes" section, many definitions and information can be found in the Notes for Chapters 61 and 62. For example, it explains what is meant by "costume" or how men's and women's clothing is defined according to the customs tariff.

Note: There are numerous explanations and customs tariff decisions for Chapters 61 and 62 that provide additional guidance on the criteria for classification.

traide Support

There is a wealth of information and legal provisions to consider when it comes to classification. If the classification is incorrect, everything is incorrect: customs duties, export declarations, preferential treatment, export control provisions, excise taxes, sales taxes, and so on.

Why Choose traide AI?

At traide, we are dedicated to the customs tariff number. Our goal with traide is to offer an intelligent software package that achieves and maintains the completeness, currency, and integrity of an entire company's product master data (sometimes millions of products) according to customs tariff requirements over time. In addition, we address the issues that arise before the actual classification process and significantly influence it. This includes, in particular, the quality of the product description, which often provides inadequate information or presents this information in an unstructured and distributed manner (e.g., in HTML format on a webshop or in product data sheets).

At its core, traide software functions as an intelligent digital customs tariff expert. It helps to quickly find the correct customs tariff number, acting as a "Tariff Assistant." It also automatically checks already classified product inventories for formal and substantive accuracy and provides feedback to the user in case of errors. The result is significantly increased throughput and a lower error rate for classified products. This frees up staff resources, creates room for scaling, and enhances security.

Do you have any questions about this? Feel free to write to us! We are happy to assist you.

Contact: info@traide.ai